SOL Price Prediction: How High Will Solana Go in November 2025?

#SOL

- SOL trading below 20-day MA at $154.14 indicates short-term bearish pressure

- $200M ETF inflows and MoonPay integration provide strong fundamental support

- Technical recovery toward $186 resistance possible if market sentiment improves

SOL Price Prediction

SOL Technical Analysis: Current Market Position and Trend Indicators

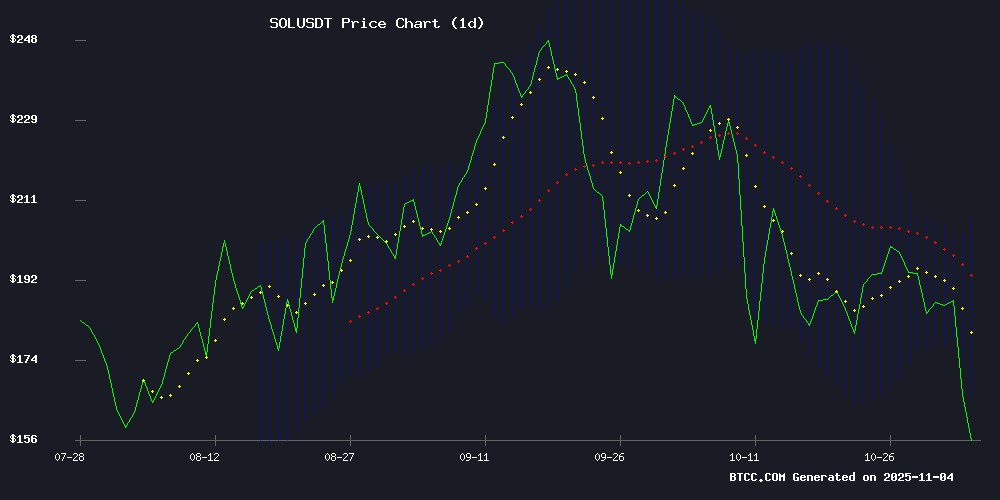

According to BTCC financial analyst Emma, SOL is currently trading at $154.14, significantly below its 20-day moving average of $186.47, indicating potential short-term bearish pressure. The MACD reading of -1.68 shows negative momentum, though the relatively narrow Bollinger Bands suggest limited volatility. The current price sits NEAR the lower Bollinger Band at $165.87, which could serve as a support level if selling pressure continues.

Market Sentiment Analysis: Positive Catalysts for SOL

BTCC financial analyst Emma notes that recent developments create a fundamentally positive backdrop for SOL. The integration of MoonPay with Pump.fun enhances fiat accessibility, while the impressive $200 million inflows into US Spot solana ETFs during their debut week demonstrate strong institutional interest. These factors, combined with optimistic November price predictions positioning SOL as a top altcoin pick, suggest growing market confidence despite current technical weakness.

Factors Influencing SOL's Price

Pump.fun Expands Fiat On-Ramps with MoonPay Integration

Pump.fun has significantly broadened its fiat payment options by integrating MoonPay, a move that streamlines access for both retail and crypto-native traders. The partnership enables direct purchases through Revolut, Venmo, Google Pay, and PayPal—bypassing the need for secondary SOL acquisitions.

The integration aligns with MoonPay's strategy to dominate crypto-fiat gateways while enhancing Pump.fun's mobile app, launched earlier this year. The platform continues to democratize meme coin trading with zero-fee portfolio tracking and creation tools.

"Seamless onboarding is critical for mass adoption," notes MoonPay's announcement, underscoring the demand for frictionless fiat-to-crypto conversions. SOL emerges as the primary beneficiary, positioned as the transactional backbone for Pump.fun's ecosystem.

US Spot Solana ETFs Record $200M Inflows In Debut Trading Week

Spot Solana ETFs have stormed onto the US market with $200 million inflows in their debut week, marking the second wave of altcoin-linked investment products after ethereum funds. Bitwise's Solana Staking ETF (BSOL) led the charge with $197 million net inflows, while Grayscale's Solana Trust (GSOL) remained dormant on Friday.

Bloomberg analyst Eric Balchunas noted BSOL's dominance: "What a week for $BSOL... ranking 16th in overall flows for the week. Big time debut." The explosive start signals growing institutional appetite for crypto exposure beyond Bitcoin, with solana emerging as a clear altcoin favorite among traditional investors.

Solana (SOL) November Price Prediction: Best Altcoin to Buy?

Solana faces resistance at $200 despite network advancements, including two new ETF launches—Bitwise's BSOL and Grayscale's GSOL. Historical trends suggest November could mark a rebound for crypto assets, with SOL positioned for potential gains.

Federal Reserve Chair Jerome Powell's cautionary remarks on economic growth and inflation have dampened investor sentiment. Yet, SOL shows technical resilience, finding support NEAR $180 and eyeing a breakout toward $200 if it clears the $196 resistance level.

Analysts are revising forecasts upward as Solana's chart structure hints at bullish momentum. Institutional products and seasonal trends may converge to fuel SOL's rally, making it a standout altcoin candidate for November.

How High Will SOL Price Go?

Based on current technical indicators and market developments, BTCC financial analyst Emma suggests SOL faces mixed signals. The technical picture shows short-term pressure with the price below key moving averages and negative MACD momentum. However, fundamental catalysts including $200M ETF inflows and improved fiat on-ramps provide strong support for medium-term recovery.

| Indicator | Current Value | Signal |

|---|---|---|

| Price | $154.14 | Below MA |

| 20-day MA | $186.47 | Resistance |

| MACD | -1.68 | Bearish |

| Bollinger Lower | $165.87 | Support |

| ETF Inflows | $200M | Bullish |

Emma expects SOL could test the $186 resistance level if positive sentiment persists, with potential movement toward $200 if ETF inflows continue and technical indicators improve.